As an investor with Contrary Capital, free-lance advisor for Southeast startups, and leader of Emory's entrepreneurship organization, I frequently have conversations with founders who are looking to synthesize their "story" prior to raising seed funding. In this series, I attempt to ask the same questions of startups that have raised seed funding from top-tier venture firms, and then back into what may have been their answer (albeit through the lens of my industry perspective).

Startup: Prodly

Backers: Shasta Ventures, Norwest Venture Partners

Raise: $3.5m (seed)

What is the simplest form of the business proposition (the Lobby Pitch™)?

Management tools for enterprise applications / configurations within the enterprise environments (namely Salesforce) aimed at simplifying IT operations.

Are they creating "space" or positioning against established players?

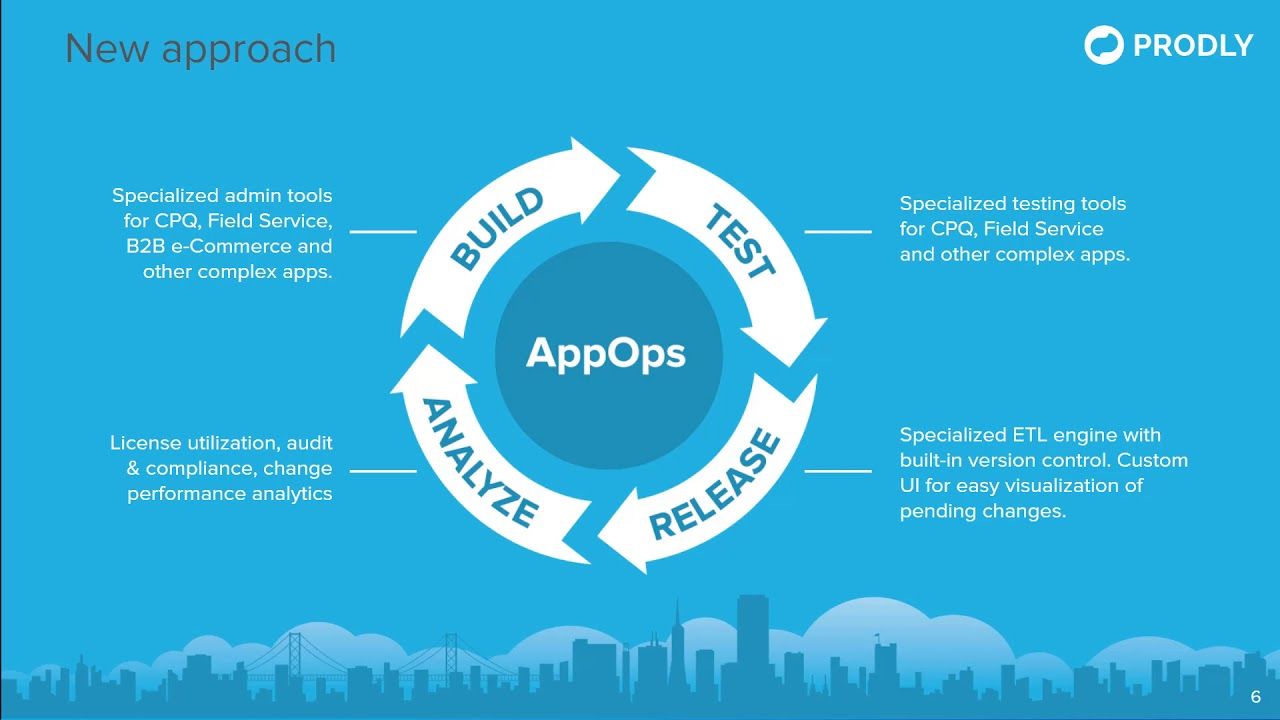

Prodly fits in an unique space tangential to DevOps called AppOps, essentially the work an IT manager must be responsible regardless of whether the environment is hosted on IaaS or utilizing PaaS or even SaaS solutions. While their core offerings of build, test, release, and monitor are similar to that of any continuous integration or application orchestration platform, their focus is on reducing extremely long lead-times between business process requirement (BPR) definition and application deployment by targeting common IT environment challenges like data integrity, version control, and referenced data deployments. This narrowness of focus and aim to bring application management outside of a limited set of IT managers positions Prodly more so against the providers (Salesforce, Oracle, SAP) than their downstream tools.

What does "product-market fit" / "stickiness" look like?

As with any back-office enterprise tool, it is necessary to see Prodly be an integral part of an IT manager's workflow. The real test, however, will be the ability for an administrator outside of IT operations to use this Prodly's toolset independently. The painpoint is more-so around the bottleneck between the other functions and IT rather than the quality of the applications actually deployed. Frequent updates like package rationalization should feel effortless and large business events like acquisitions or business model changes should feel manageable.

What would "success" mean in the 5-year horizon?

Prodly is currently focused on Salesforce and specifically on the CPQ, billing, and field service environments. The goal would certainly be to expand to the rest of Salesforce's offerings and potentially even act as a unified platform across ERP, CRM, etc. application release and testing. Success could also mean creeping into the development space, rather than focusing on the test and release phases. Rather than simply supporting for "low-code" applications, Prodly could move into specific tools that make designing these applications more efficient and robust.

What are some market forces (headwinds or tailwinds) that could impact that?

Large enterprise players certainly have an incentive to fix the application management bottleneck to remain competitive and natively support vital toolsets their customers rely on. This could either result in Prodly being a prime acquisition target, or a situation where most of Prodly's advantages are adsorbed into the provider's platforms. Also, migrating, testing, and deploying these applications often falls upon professional service firms (e.g., Cognizant), which are currently in the process of developing similar tools that allow them to stay in the loop at large enterprises.