As an investor with Contrary Capital, free-lance advisor for Southeast startups, and leader of Emory's entrepreneurship organization, I frequently have conversations with founders who are looking to synthesize their "story" prior to raising seed funding. In this series, I attempt to ask the same questions of startups that have raised seed funding from top-tier venture firms, and then back into what may have been their answer (albeit through the lens of my industry perspective).

Startup: Kapwing

Backers: Kleiner Perkins, Shasta Ventures, Sinai Ventures, Village Global, Shrug Capital, ZhenFund

Raise: $1.7m (seed)

What is the simplest form of the business proposition (the Lobby Pitch™)?

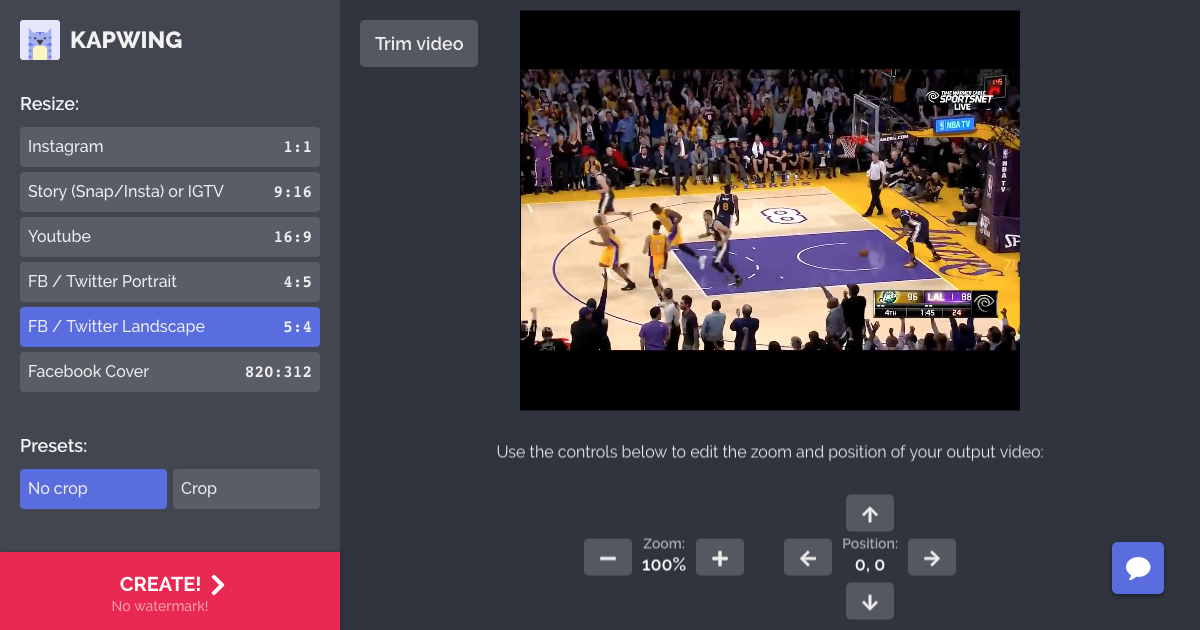

Lightweight, browser-based content creation tool aimed at newly prevalent formats (such as memes or square Instagram videos), for lean design teams or individual creators.

Are they creating "space" or positioning against established players?

Kapwing is creating space for a new set of design tools aimed not at professional brands teams that have established workflows, design guidelines, asset management, etc. but at upstart brands or individuals that want to hit the ground running. In that way, they are positioned more against an iMovie (give-away tool, extremely limited functionality, but high usability) than a Final Cut Pro. They are also creating a consolidation / analytics tool for culturally relevant but often ephemeral media (gifs, memes, etc.), something that isn't currently being pursued by other players.

What does "product-market fit" / "stickiness" look like?

Kapwing is certainly going after creators focused on quantity over quality, so "product-market fit" would mean high engagement not only with editing but publishing / exporting on a frequent basis (likely weekly). In the same vein, the rate of completion from creating a new project to publishing would likely need to be high to warrant continued use of a targeted, nascent, feature-poor option. And like most SaaS solutions, conversion from free-tier, activated customers to paying, retained customers will point to whether customers feel the solution meets the need for their consistent creation pipeline vs. one-off video resizing or background removal.

What would "success" mean in the 5-year horizon?

Signing on a "long-tail" of SMBs or individual creators to paid accounts is key, but if Kapwing can tailor their content tools so effectively to new use cases that users clamor for verticalization into social media management (e.g., Buffer) and asset management (e.g. Creative Cloud), there is potential for a really defensible position.

What are some market forces (headwinds or tailwinds) that could impact that?

Entrants by direct competitors in the content creation space is certainly a risk, but the larger headwind may be from social platforms incorporating much of Kapwing's toolsets natively into their offerings. Facebook/Instagram, Twitter, etc. have created a host of extremely successful complementary businesses, but there seems to be an emerging trend from these platforms to better understand their users and recapture certain revenue or engagement models (e.g., Facebook Marketplace replacing Buy & Sell groups). These platforms also have access to a wealth of data that if utilized, would certain advantage them when designing targeted tools. Tailwinds are certainly the continuing democratization of content creation (influencers vs. traditional media) and the "create from anywhere" trend discouraging long lead-times between capture and publishing.