As an investor with Contrary Capital, free-lance advisor for Southeast startups, and leader of Emory's entrepreneurship organization, I frequently have conversations with founders who are looking to synthesize their "story" prior to raising seed funding. In this series, I attempt to ask the same questions of startups that have raised seed funding from top-tier venture firms, and then back into what may have been their answer (albeit through the lens of my industry perspective).

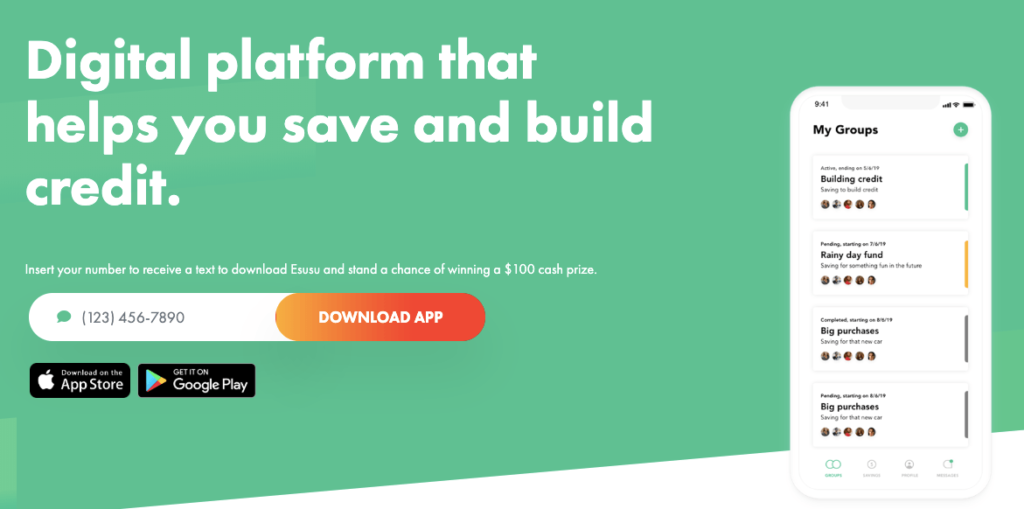

Startup: Esusu

Backers: Acumen Fund Sinai Ventures, Kleiner Perkins, Katapult Accelerator, Plug and Play Tech Center, Global Good Fund, Temerity Capital Partners

Raise: $1.6m (seed)

What is the simplest form of the business proposition (the Lobby Pitch™)?

Platform enabling benefits of rotating credit and savings associations to groups of young, struggling savers, with additional benefit of direct-line reporting to credit agencies.

Are they creating "space" or positioning against established players?

Many new entrants are hoping to tackle the gap of credit and money management for those currently unable to participate in traditional institutions. Disregarding the many predatory offerings, many startups have sought alternative ways to boost credit scores (e.g., MoCaFi), and Esusu fits firmly into that landscape. However, its innovative approach, allowing friends and family to offer each other no-interest loans in a rotating format, and its deep integration into banking systems and credit agencies (namely Equifax) provide a level of separation, that, if it proves attractive to its core audience, could make it the preferred provider of this service.

What does "product-market fit" / "stickiness" look like?

Unlike other offerings, Esusu is not promising to "instantly" boost a customer's credit status through additional reporting or debt refinancing / consolidation. Therefore, the customers must find the Esusu's savings vehicle to be beneficial from both a pecuniary and behavioral perspective. Retained customers would need to invite their friends and family onto the platform and participate in multiple pay cycles for the concept to be fully realized, especially as the fee structure is based on pay cycles rather than percentage of transaction value.

What would "success" mean in the 5-year horizon?

Financial literacy is a huge goal for many fintech startups, but Esusu's unique approach requires specific customer education on the value of its financial service (rotating savings groups), a challenge not generally shared by, for example, a mobile-first brokerage. Success would mean establishing rotating savings groups with mainstream finance, and then expanding Esusu's offerings to either traditional banking (i.e., home, auto, other personal loans) with potentially alternative repayment options and/or other forms of P2P lending (similar to that of Lending Club) in an open marketplace.

What are some market forces (headwinds or tailwinds) that could impact that?

Consumer hesitation to adopt new financial practices may prove an insurmountable obstacle, preventing widespread adoption of Esusu's solution. However, more near-term is the risk of major credit agencies either minimizing the impact of completing pay cycles within a savings group on an individual's credit profile or changing their direct-line relationship with providers like Esusu. Nevertheless, there is an unfortunately trend towards financial instability in many countries, which may buoy previously underutilized solutions into mainstream adoption.